Shopsy online shopping

Browse Categories

- Furniture

Furniture

Furniture is an integral part of our daily lives, providing comfort, functionality, and aesthetic appeal to our living spaces. From ancient civilizations to modern times, the evolution of furniture has been a fascinating journey. This comprehensive guide aims to delve into the world of furniture, exploring its history, types, materials, and the latest trends.

The Historical Evolution of Furniture

Ancient Furniture: From Early Civilizations to the Middle Ages

- Overview of furniture in ancient Mesopotamia, Egypt, Greece, and Rome

- The craftsmanship of medieval furniture and its influence on design

Renaissance and Baroque Periods: The Birth of Artistic Furniture

- Intricate details and ornate designs of Renaissance furniture

- Baroque influence on furniture during the 17th century

The Industrial Revolution: Mass Production and Innovation

- Impact of the Industrial Revolution on furniture manufacturing

- Introduction of new materials and styles during the 19th century

Types of Furniture

Residential Furniture: Enhancing Home Comfort

- Living room furniture: sofas, chairs, coffee tables

- Bedroom furniture: beds, dressers, nightstands

- Dining room furniture: tables, chairs, buffets

Office Furniture: Ergonomics and Productivity

- Desks, chairs, and storage solutions for the modern workplace

- Trends in home office furniture with the rise of remote work

Outdoor Furniture: Bridging the Gap Between Indoors and Outdoors

- Patio sets, outdoor sofas, and dining furniture

- Weather-resistant materials and maintenance tips

Specialized Furniture: From Antique to Modern

- Antique furniture: collectors' items and historical value

- Custom and bespoke furniture for unique preferences

Materials Used in Furniture Construction

Wood: A Timeless Favorite

- The durability and versatility of different wood types

- Sustainable and eco-friendly wood sourcing practices

Metal: Modern and Industrial Aesthetics

- Steel, aluminum, and other metal alloys in furniture design

- Contemporary trends in metal furniture

Upholstery and Fabrics: Adding Comfort and Style

- Importance of fabric selection in upholstery

- Trends in color, texture, and patterns for fabric-covered furniture

Synthetic Materials: Durability and Affordability

- Plastic, laminate, and composite materials in furniture

- Pros and cons of synthetic materials in furniture construction

Design Trends in Modern Furniture

Minimalism: Less is More

- Clean lines, simple shapes, and functional designs

- Integration of minimalism in various furniture pieces

Sustainable and Eco-Friendly Furniture

- The rise of environmentally conscious design

- Recycled materials and sustainable practices in furniture manufacturing

Smart Furniture: Embracing Technology in Design

- Integration of technology in furniture for convenience

- Examples of smart furniture and their functionalities

Mix and Match: Eclectic Design Approaches

- Blending different styles, colors, and materials for a unique look

- Tips for achieving a cohesive eclectic design in furniture

Conclusion: As we traverse through the rich history, diverse types, and evolving trends in the world of furniture, it becomes evident that furniture is more than just functional pieces—it is a reflection of our culture, lifestyle, and design preferences. Whether it's the timeless appeal of wooden classics or the futuristic designs of smart furniture, the world of furniture continues to captivate and inspire us, shaping the way we experience and interact with our living spaces.

- Cooking

Cooking

Cooking is an art that transcends the boundaries of culture, geography, and time. It is a universal language that speaks to our senses, connecting us through the joy of flavors and the satisfaction of a well-prepared meal. In this comprehensive exploration, we will delve into the diverse facets of cooking, from its historical roots to the modern culinary landscape. Join us on a gastronomic journey as we uncover the secrets, techniques, and cultural significance of cooking.

The Historical Tapestry of Cooking

Early Culinary Practices

The history of cooking dates back to ancient times when humans discovered fire and began experimenting with different methods of preparing food. Explore the evolution of cooking techniques, from roasting over an open flame to the development of rudimentary cookware.

Culinary Traditions Around the World

Every culture has its unique culinary traditions that reflect its history, geography, and available ingredients. Uncover the fascinating stories behind iconic dishes from various regions, showcasing the diversity of cooking methods and flavor profiles.

The Science of Cooking

The Chemistry of Flavor

Delve into the molecular world of cooking and understand how chemical reactions transform raw ingredients into a symphony of flavors. Learn about the Maillard reaction, caramelization, and other processes that contribute to the complexity of taste.

The Role of Heat in Cooking

Heat is a fundamental element in cooking, influencing the texture, color, and taste of ingredients. Explore the different heat transfer methods used in cooking, from conduction to convection, and discover how chefs master the art of temperature control.

Culinary Techniques

Knife Skills: The Foundation of Every Chef

A sharp knife is a chef's best friend. Uncover the importance of knife skills in the culinary world, from basic cutting techniques to advanced precision cuts. Learn how to choose the right knife for each task and maintain its sharpness.

Essential Cooking Methods

Whether it's sautéing, braising, or sous-vide, each cooking method imparts a distinct character to the dish. Explore the essential cooking techniques that form the backbone of culinary mastery, with practical tips for perfecting each method.

The Art of Flavor Pairing

Understanding Flavor Profiles

Unlock the secrets of flavor by dissecting the components that make up a dish. From sweet and savory to umami and bitter, explore the nuances of flavor profiles and how chefs balance them to create a well-rounded culinary experience.

Pairing Ingredients: A Symphony of Tastes

Discover the art of ingredient pairing and how chefs combine diverse elements to elevate their dishes. From classic combinations to avant-garde pairings, explore the creative process behind crafting harmonious flavor marriages.

Cultural Influences on Cooking

Fusion Cuisine: Where Tradition Meets Innovation

As the world becomes more interconnected, culinary traditions blend in unexpected ways. Explore the phenomenon of fusion cuisine, where chefs draw inspiration from diverse cultures to create dishes that celebrate global flavors.

Rituals and Symbolism in Cooking

Food is often deeply intertwined with cultural rituals and symbolism. Delve into the significance of culinary practices in various cultures, from the symbolism of certain ingredients to the role of food in religious ceremonies.

Cooking in the Digital Age

The Rise of Food Tech

From smart kitchen appliances to virtual cooking classes, technology is transforming the way we approach cooking. Explore the innovations that are shaping the culinary landscape and how chefs leverage technology to enhance their skills.

Social Media and the Food Revolution

Instagram-worthy dishes, viral recipes, and food influencers – social media has become a powerful force in the culinary world. Examine the impact of platforms like Instagram and TikTok on food trends, aesthetics, and culinary storytelling.

Sustainable Cooking

Farm-to-Table Movement

The farm-to-table movement emphasizes the importance of sourcing local, sustainable ingredients. Learn about the benefits of supporting local farmers, reducing food miles, and the impact of this movement on both the environment and the quality of our meals.

Plant-Based Revolution

As concerns about environmental sustainability and health grow, more people are embracing plant-based diets. Explore the world of plant-based cooking, from innovative meat substitutes to creative vegetable-centric dishes.

The Future of Cooking

Culinary Trends in the 21st Century

What does the future hold for the world of cooking? Examine emerging culinary trends, from unique ingredients and cooking techniques to cultural influences that are shaping the way we eat. Predictions from culinary experts provide insight into what lies ahead.

Conclusion: In this culinary odyssey, we've embarked on a journey through the rich history, scientific intricacies, and cultural influences that define the world of cooking. Whether you're a seasoned chef or an enthusiastic home cook, the art of cooking continues to evolve, inviting us to explore new flavors, techniques, and possibilities. As we savor the diverse tapestry of global cuisine, one thing remains certain – cooking is a timeless expression of creativity and a celebration of the universal language of taste.

- Cars

Car Accessories

Car Accessories: In the dynamic world of automotive innovation, car accessories play a pivotal role in enhancing the overall driving experience. From practical add-ons that improve safety and functionality to stylish embellishments that reflect personal taste, the market for car accessories is diverse and ever-evolving.

This comprehensive article delves into the exciting realm of car accessories, exploring various categories that cater to different needs and preferences.

The Evolution of Car Accessories

Understanding the history and evolution of car accessories provides valuable insights into how these enhancements have evolved alongside the automotive industry. From humble beginnings with basic functional additions to today's cutting-edge technological advancements, car accessories have come a long way in shaping the driving experience.

Essential Accessories for Safety and Functionality

Safety on the road is paramount, and car accessories designed to enhance it have become indispensable. This section explores essential safety accessories such as airbags, anti-lock braking systems (ABS), dash cameras, and parking sensors. Additionally, we'll delve into accessories that improve functionality, including roof racks, cargo organizers, and towing kits.

Stylish Additions

Car enthusiasts often seek ways to personalize their vehicles, and this chapter explores a myriad of stylish accessories for both the interior and exterior. From custom seat covers, floor mats, and ambient lighting to exterior upgrades like alloy wheels, spoilers, and decals, discover how these accessories can transform a car into a reflection of the owner's personality.

Tech Innovations in Car Accessories

The digital age has ushered in a new era of tech-savvy car accessories. This chapter explores the latest technological innovations, including smart mirrors, GPS navigation systems, Bluetooth-enabled devices, and entertainment systems. Discover how these accessories not only make driving more enjoyable but also contribute to a connected driving experience.

Engines, Exhausts, and Suspension

For automotive enthusiasts seeking to enhance their vehicle's performance, this chapter explores accessories designed to boost horsepower, improve handling, and optimize the exhaust system. From aftermarket air intakes and performance exhausts to suspension upgrades, learn how these additions can take a car's performance to the next level.

Eco-Friendly Accessories for Sustainable Driving

As environmental concerns become more prevalent, this chapter focuses on eco-friendly car accessories. From solar-powered ventilation systems to electric vehicle charging stations and eco-friendly seat covers, discover how car owners can contribute to sustainable driving practices.

In conclusion, the world of car accessories is a vast and exciting landscape, offering something for every type of car owner. Whether prioritizing safety, style, technology, or performance, the diverse range of accessories available ensures that drivers can tailor their vehicles to meet their unique needs and preferences.

As automotive technology continues to advance, so too will the innovation in car accessories, promising an even more exciting future for car enthusiasts around the world.

- Fashion

Fashion

Fashion is not merely the clothes we wear; it's a form of self-expression, a reflection of our personality, and a mirror of the society we live in. The world of fashion is dynamic, constantly evolving, and influenced by various factors such as culture, technology, and individual tastes. This article delves into the multifaceted realm of fashion, exploring its historical roots, its impact on society, and the ever-changing landscape of trends.

The Evolution of Fashion Through History

- Ancient Influences: From ancient civilizations to the medieval era, explore how clothing has been a marker of status, occupation, and societal norms.

- Renaissance to Industrial Revolution: Witness the transition from elaborate Renaissance fashion to the functional attire of the Industrial Revolution.

Cultural Diversity in Fashion

- Traditional Attire: Discover how different cultures have preserved their identity through traditional clothing, often showcasing intricate craftsmanship and symbolism.

- Globalization and Fusion: Analyze the impact of globalization on fashion, leading to the fusion of styles from around the world.

The Power of Fashion in Society

- Social Influence: Examine how fashion shapes societal perceptions and influences social dynamics, touching upon topics like body image and self-esteem.

- Fashion as a Political Statement: Investigate instances where clothing has been used as a tool for political expression and protest.

Technology and Fashion

- Digital Revolution: Explore the role of technology in revolutionizing the fashion industry, from online shopping to virtual fashion shows.

- Sustainable Fashion: Discuss the growing importance of sustainability in fashion and how technology contributes to eco-friendly practices.

Fashion Icons and Influencers

- Iconic Figures: Celebrate legendary fashion icons who have left an indelible mark on the industry, exploring their impact on trends and style.

- The Rise of Social Media Influencers: Examine the role of social media in shaping contemporary fashion trends and the influence of online personalities.

The Business of Fashion

- Fashion Industry Dynamics: Investigate the economic aspects of the fashion industry, from design and manufacturing to marketing and retail.

- Fast Fashion vs. Sustainable Fashion: Compare the pros and cons of fast fashion and sustainable fashion, considering their environmental and ethical implications.

Trends Through the Decades

- From Flapper Dresses to Power Suits: Take a nostalgic journey through the fashion trends of different decades, exploring the cultural and societal influences that shaped each era.

- Revival of Retro Styles: Analyze the cyclical nature of fashion trends and the resurgence of vintage styles in modern times.

Fashion and Gender Identity

- Breaking Gender Norms: Discuss how fashion has played a pivotal role in challenging traditional gender norms, paving the way for inclusivity and diversity.

- Unisex and Gender-Neutral Fashion: Explore the rise of unisex and gender-neutral fashion lines, reflecting a more progressive and inclusive approach.

The Future of Fashion

- Technological Innovations: Delve into emerging technologies such as augmented reality and artificial intelligence and their potential impact on the future of fashion.

- Sustainability as a Driving Force: Discuss how the fashion industry is evolving to meet the demands for sustainable and ethical practices, shaping the future landscape.

Conclusion: Fashion is an ever-evolving tapestry that weaves together history, culture, and individual expression. As we navigate the complex world of trends and styles, it is essential to appreciate the diverse influences that contribute to the rich tapestry of the fashion industry. From its ancient roots to the digital age, fashion continues to be a powerful force that reflects, shapes, and defines our society. As we step into the future, the only certainty is that the world of fashion will continue to captivate, inspire, and evolve.

- Bags

- Kids

- Shoes

- Electronics

- Home Decor

- Clocks

-

Wall Clocks

- Big Wall Clocks

- Cool Wall Clocks

- Decorative Wall Clocks

- Digital Wall Clocks

- Glass Wall Clocks

- Wall clocks hands only

- Kitchen Wall Clocks

- Large Wall Clocks

- LED Wall Clocks

- Metal Wall Clocks

- Mirror Wall Clocks

- Modern Wall Clocks

- Pendulum Wall Clocks

- Silent Wall Clocks

- Skeleton Wall Clocks

- Small Wall Clocks

- Square Wall Clocks

- Traditional Wall Clocks

- Vintage Wall Clocks

- Wooden Wall Clocks

-

Wall Clocks

- Beauty

Key cover

Key cover: In the vast ecosystem of insurance products, key cover might seem like a minor player. However, its importance often becomes glaringly apparent in those moments of panic when keys are misplaced, lost, or stolen. What seems like a mundane object holds the power to disrupt our lives significantly. In this comprehensive exploration, we delve into the world of key cover, unraveling its significance, types, benefits, and considerations for choosing the right policy.

Showing the single result

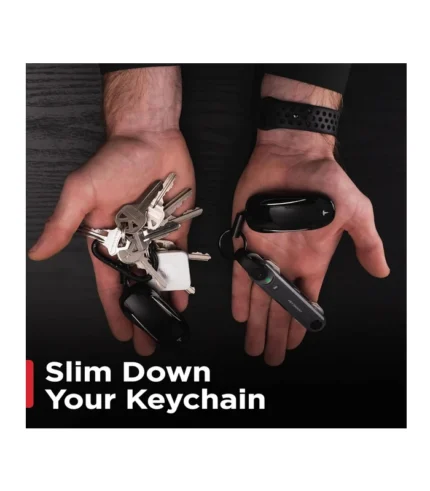

KeySmart Max Trackable Smart Key Organizer

KeySmart Max Trackable Smart Key Organizer: In a world where convenience is king, the quest for efficiency in everyday tasks has led to the innovation of various smart devices. Among these innovations is the KeySmart Max Trackable Smart Key Organizer, a revolutionary solution to the perennial problem of managing keys.

Understanding Key Cover

Key cover, in its essence, provides financial protection against the loss, theft, or damage of keys. These keys may include those for homes, vehicles, workplaces, or other important spaces. Key cover typically goes beyond the cost of replacing keys; it often extends to cover expenses related to locksmith services, reprogramming electronic keys, and even replacing locks if necessary.

Types of Key Cover

- Home Key Cover: This type of policy protects the keys to your home. It offers reimbursement for locksmith services and replacement of locks in case of lost or stolen keys.

- Vehicle Key Cover: Vehicle key cover extends protection to keys for cars, motorcycles, or any other mode of transport. It covers the cost of replacement keys and, in some cases, the reprogramming of electronic keys.

- Commercial Key Cover: Businesses can opt for key cover to protect keys to their premises, offices, or other commercial spaces. This often includes coverage for replacing locks and reissuing keys to employees.

- Comprehensive Key Cover: Some insurers offer comprehensive key cover that encompasses all types of keys under one policy. This provides a holistic solution for individuals or families with diverse key-related needs.

Benefits of Key Cover

- Financial Protection: Key cover offers financial security by mitigating the costs associated with lost, stolen, or damaged keys. Instead of bearing the entire expense of replacing keys and locks, policyholders pay a nominal premium.

- Convenience: Losing keys can be a stressful experience, especially if it happens at inconvenient times. Key cover provides peace of mind by offering swift assistance in such situations. Most policies include a helpline for emergency locksmith services, ensuring prompt resolution.

- Customization: Insurance providers often allow policyholders to customize their key cover based on individual requirements. This flexibility enables people to tailor the policy to their specific needs, whether it's for a single property or multiple assets.

- Additional Services: Beyond key replacement, some key cover policies offer additional services such as emergency transportation, accommodation, or even retrieval of spare keys. These added benefits enhance the overall value proposition of the policy.

Considerations for Choosing Key Cover

- Coverage Limits: It's crucial to understand the coverage limits of the key cover policy. Ensure that the policy adequately covers the replacement costs of keys, locksmith services, and any associated expenses.

- Exclusions: Familiarize yourself with the exclusions of the policy. Certain scenarios, such as negligence or leaving keys unattended in public places, may not be covered. Understanding these exclusions helps manage expectations and prevents surprises during claims.

- Premium Costs: Compare premium costs across different insurers to find a balance between affordability and coverage. While opting for the cheapest policy might seem appealing, it's essential to assess the overall value offered in terms of coverage and services.

- Claim Process: Evaluate the ease and efficiency of the claim process. A streamlined claims procedure ensures that you receive prompt assistance when you need it the most. Look for insurers with a reputation for excellent customer service and hassle-free claims settlement.

Case Studies: Real-Life Scenarios

1. Sarah's Home Key Mishap

Sarah, a working professional, accidentally misplaced her house keys while rushing to catch a morning meeting. Panicked, she contacted her insurer's helpline and was relieved to find out that her key cover policy included emergency locksmith services. A locksmith arrived promptly, replaced the locks, and issued new keys, sparing Sarah from any inconvenience.

2. David's Car Key Dilemma

David, an avid traveler, found himself stranded in a remote location after losing his car keys during a hiking trip. Fortunately, David had opted for comprehensive vehicle key cover, which included provisions for emergency transportation. His insurer arranged for a rental car, allowing David to continue his journey while his car keys were replaced.

Conclusion: Key cover may seem like a minor insurance product, but its significance becomes apparent in moments of crisis. By providing financial protection, convenience, and added services, key cover policies offer invaluable support in situations involving lost, stolen, or damaged keys. When choosing a key cover policy, it's essential to consider factors such as coverage limits, exclusions, premium costs, and the efficiency of the claim process. By making an informed decision, individuals can safeguard themselves against the uncertainties associated with key-related mishaps.